| Header | Content |

|---|---|

| Author | Ermin (@ermin) |

| Created | 2021-11-19 |

| Status | Completed |

Motivation

dHEDGE should target to:

- Grow its Protocol Treasury

- Increase DHT liquidity and Protocol Controlled Value (PCV)

- Lower DHT emissions

- Increase TVL

As the Protocol Treasury grows, more value is generated for DHT Stakers on a quarterly basis. Today, the majority of the DHT Staking Rewards distribution is in the form of DHT circulating Inflation. This is long term unsustainable, and it’s important to grow the Protocol Treasury to a level where the staking APY can be sustained by the Protocol Treasury. Likewise, Performance Mining DHT Rewards are an improvement with V2 but still could create more value for the protocol.

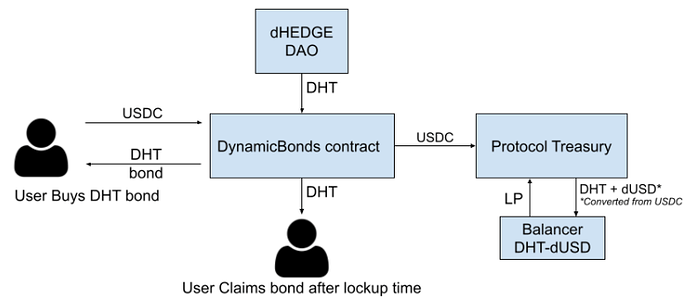

With the rise of Olympus DAO, a new form of Bonds and Protocol Controlled Value can be created to achieve all 4 goals listed above, named Dynamic Bonds.

Description

Before getting into Dynamic Bonds, a quick overview of Olympus DAO:

Olympus has shown that it’s more efficient and sustainable to sell native token Bonds at a discount to build protocol-owned liquidity. Until now, projects were mostly giving tokens away ‘for free’ via liquidity mining. The issue with liquidity mining was described by Andre Cronje as the ‘something for nothing’ problem.

The dHEDGE core team explored various options and found that it could improve on the Olympus bonds model with Dynamic Bonds.

Dynamic Bonds take the Olympus Bonds model and improve it in the following ways:

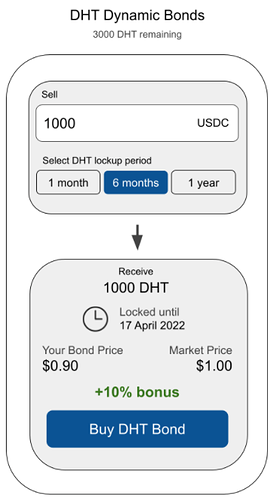

- Buyers can enter with USDC (no need to buy another token or LP)

- Tokens are locked rather than vested, deferring any sell pressure

- Buyers can decide on the lockup time period that suits them from 1 week to 1 year (dynamic time duration). Buyers are incentivised to lock up longer.

- Liquidity pairing is not fixed (dynamic liquidity and treasury allocation controlled by governance)

- Proposal to initially add liquidity for DHT-dUSD to build both liquidity and yield for the treasury

DHT Bond sales can run weekly.

Propose 25k DHT bond sales per week, to start with.

A Dynamic Bond Buyer can decide on the lock duration and DHT Bond discount as per the following proposal, the idea being to incentivize longer lockups:

- 1 week lockup: 5% discount

- 1 month lockup: 15% discount

- 6 month lockup: 30% discount

- 1 year lockup: 45% discount

Edit: increased longer time period discounts by 5% to better compete with staking, incentivize longer lockup and kick off to a strong start. Can re-assess after the first 25k DHT.

Note that the bond lockups compete with DHT Staking Rewards, so the discounts need to be attractive in comparison to Staking to generate protocol-owned liquidity.

Bond sales will generate revenue for dHEDGE and will go into a DHT-dUSD Balancer pool. This will:

- Create buy pressure for DHT (by minting DHT-dUSD)

- Create liquidity for DHT

- Increase TVL via a dUSD liquidity pool

- Grow in value over time (dUSD is a productive yield bearing asset)

Note that Dynamic Bonds can run in conjunction with Olympus Pro, which is also in discussion.

Implementation

Create a new Dynamic Bonds contract with functions to:

- Deposit: Accepts USDC and creates a new bond for the user

- Claim: Closes the bond and transfers DHT after lockup period expires

- Set Bond Terms: Initializes the bond terms

- Add / Update Bond Options: Adds bond options with different time lockups and discounts