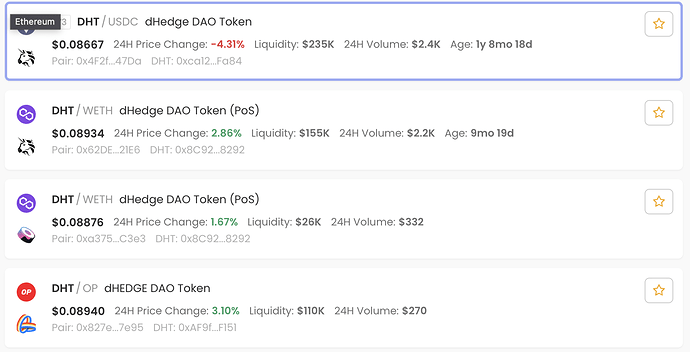

Currently, the liquidity of the $DHT token is divided into 4 pools, on 3 different chains.

Almost 50% of the liquidity is on Ethereum L1.

This is a problem, a barrier to entry for newcomers who would like to gain exposure to the token.

Given the dhedge’s evolution, and the fact that most of the dApp activity is done on Optimism now, I think it would be interesting to bring all of this liquidity together, into one pool, on Velodrome (Optimism).

Staking will also be stopped on ethereum L1, so holding tokens on this chain will no longer be of interest.

Also, the chain costs are relatively lower on Optimism than on L1, especially during peak periods (if the bullrun comes back).

I’d like, before proceeding to a vote, to have your feedback. If you think it has negative effects or not.