Now with Staking v2.0 dHEDGE Staking 2.0

it’s too complicated in my opinion. Most investors will not take the time to get involved.

So I wanted this topic to be the start of conversation about the optimal DHT tokenomics tweaks that will the same time be … KISS. What do you think?

I think the current model is good, we dont need outsiders getting involved in governance.

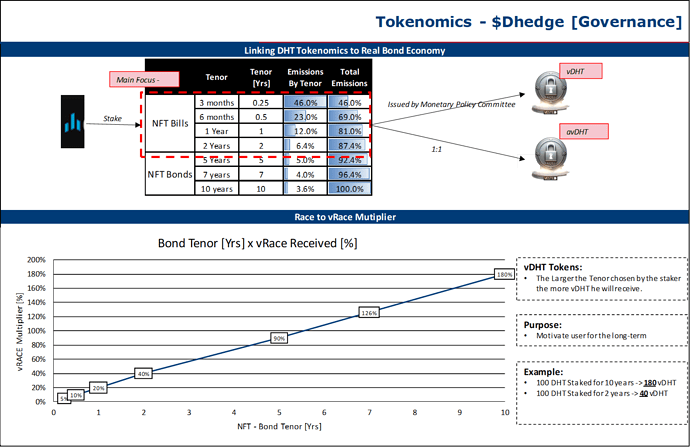

However, what we can do is a sub committee to do like the us treasury does. Fixed Maturities with fixed issued interests. These generate NFT’s which are then traded in secondary market.

how they do it today is like this:

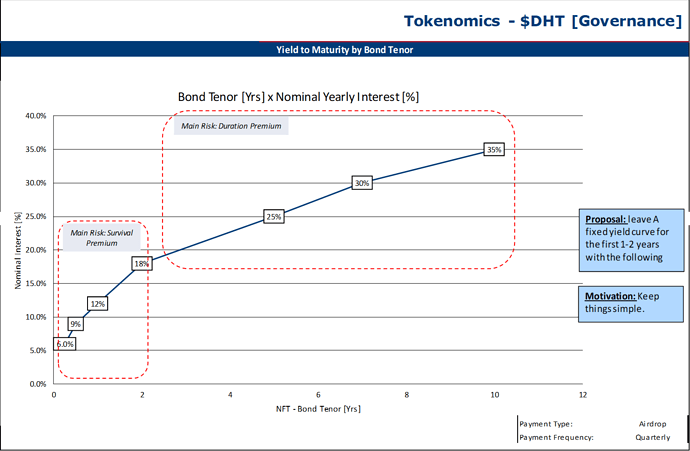

The APY per tenor should be set by a Monetary Policy Committee that should be voted on by current DHT token holders. but a APY should look like this:

I’m doing this way for a L2 i’m working with.

Simplifying makes a lot of sense.

The idea was to make any DHT rewards be tied to the protocol directly. So any DHT rewards would also create value for the protocol (ie. TVL that generates fees).

The “stake token and earn emissions” model is a bit old school and doesn’t give anything back to the protocol. It’s giving something for nothing. Even wrapping it in NFTs and having some tranches - at its core it’s still inflation for just locking supply.

Ideally it should be inflation for locking supply and providing valuable TVL that’s generating fees.