| Header | Content |

|---|---|

| Author | Mat Nelsen(@taminater) |

| Created | 2022-7-12 |

| Status | Draft |

Motivation

See also: Initial forum post

The Status Quo of Staking DHT

The current dHEDGE staking system rewards DHT holders that choose to lock up their DHT in return for vDHT.

These stakers then benefit in four ways:

-

Being rewarded with inflationary incentives,

-

Control and exposure to the dHEDGE Protocol Treasury,

-

The ability to vote on DAO proposals and steer the direction of dHEDGE and

-

The ability to earn increased performance mining rewards.

Currently, DHT is emitted to stakers through one of two methods:

- As direct incentive for staking DHT, proportional to the allocation of vDHT held via a lockup calculation, and

- Via performance mining - a method that rewards investing in well performing pools. Investors are eligible for a max of 100 DHT a month rewards without any DHT staked; however with staked DHT these rewards increase.

Problems

-

Token emissions are not tightly correlated enough with prudent investor behaviour (i.e. investing in well performing pools) and protocol engagement (buying DHT, participating in governance, investing in dUSD and other dHEDGE products)

-

Staking only available on Ethereum Mainnet, which is expensive to claim due to gas.

Proposed New DHT Staking

The main purpose of DHT is to provide a boost to positive investing behaviour.

Via staking DHT together with dHEDGE pool tokens, a staker is able to amplify the returns they’re achieving through investment activity.

The amplification is achieved by a combination of three factors:

-

The amount of vDHT

-

The amount of time staked (Duration Bonus), and

-

The performance of the invested dHEDGE pool (Performance Bonus)

As dHEDGE protocol revenue is a direct function of pool fees, the design of this staking mechanism is directly aligned to reward successful investing behaviour.

The effect of these changes will:

- Improve the utility of DHT token as a method of boosting investing returns

- Simplify the earning of governance power

- Increase the attractiveness of holding DHT to increase investing returns

Description

This proposal will move staking DHT away from Ethereum L1 to both Polygon and Optimism.

Proposed is to:

-

Simplify the method of accruing voting power via accruing a staker’s vDHT linearly over time, starting at 0. vDHT accrues to parity with the staked DHT after 12 months.

-

Only emit DHT rewards to users staking both DHT and dHEDGE pool tokens. Staking DHT alone will not be subject to staking rewards. Rewards are emitted when staked DHT (vDHT) is paired with some staked dHEDGE pool tokens.

Note: A new dHEDGE pool that will only hold DHT as an asset will be created. This can be paired with vDHT so a staker only has exposure to DHT.

Example 1

Nancy stakes 1000 DHT and commences accruing vDHT. Nancy is also invested in the pool - Conservative Fund.

Nancy stakes $200 of the Conservative Fund pool tokens and pairs this with her vDHT.

After 3 months of being staked, Nancy has accrued 250 vDHT, and the performance of Conservative fund has increased 20%. From the Duration and Performance bonus charts,

- 3 months staking equates to a Duration Bonus of 0.5,

- 20% pool performance increase equates to a Performance Bonus of 0.4

Therefore:

Where:

vDHT = Staked DHT

S = Staking Ratio of vDHT:DHPT

$DHPT = Initial $ value of dHEDGE pool tokens

p = Performance Bonus

t = Duration Bonus

E = Emissions Rate

n = the total amount of different DHPT tokens

Staking Rewards = 1 * 200 * 0.5 * 0.4 * 6 = 240 DHT

If Nancy unstaked her DHPT her position would look like:

DHPT = $240

vDHT = 250(1000DHT)

Staking Rewards = 240 DHT

Total $ Value = $388.80($0.12 DHT price)

Should Nancy choose to not claim, and instead hold her staked Pool tokens and re-evaluate 3 months later, she would be also making a decision based on a forecast performance of the Conservative fund.

Let’s say 3 months later the Conservative fund is now at 30% pool performance increase from when Nancy initially staked, her staking bonuses would be:

- vDHT has accrued to 500 (after 6 months staking)

- 6 months staking equates to a Duration Bonus of 1.0,

- 30% pool performance increase equates to a Performance Bonus of 0.6

Staking Rewards = 1 * 200 * 0.6 * 1 * 6 = 720 DHT

If Nancy unstaked her DHPT her position would look like:

DHPT = $260

vDHT = 500(1000DHT)

Staking Rewards = 720 DHT

Total $ Value = $466.40($0.12 DHT price)

In the above example if the Conservative fund had increased 50% instead of 30%, Nancy would get the maximum performance bonus of 1.0.

Her staking bonuses would be:

Staking Rewards = 1 * 200 * 1 * 1 * 6 = 1200 DHT

DHPT = $300

vDHT = 500(1000DHT)

Staking Rewards = 1200 DHT

Total $ Value = $564($0.12 DHT price)

Example 2

Geoff only wants exposure to DHT. In this case he will invest in the DHT only dHEDGE pool.

Initially he stakes 1000 DHT and commences accruing vDHT. Geoff invests and stakes his $200 of the DHT only pool tokens.

After 3 months the price of DHT is $0.18 his potential staking bonuses would be:

- vDHT has accrued to 250 (after 3 months staking)

- 3 months staking equates to a Duration Bonus of 0.5,

- 50% pool performance increase equates to a Performance Bonus of 1.0

Staking Rewards = 1 * 200 *1 * 0.5 * 6 = 600 DHT

DHPT = $300

vDHT = 500(1000DHT)

Staking Rewards = 600 DHT

Total $ Value = $588($0.18 DHT price)

Should Geoff choose to not claim, and re-evaluate 3 months later. The price of DHT is now $0.24

His staking bonuses would be:

- vDHT has accrued to 500 (after 6 months staking)

- 6 months staking equates to a Duration Bonus of 1.0,

- 100% pool performance increase equates to a Performance Bonus of 1.0

Staking Rewards = 1 * 200 * 1 * 1 * 6 = 1200 DHT

DHPT = $400

vDHT = 500(1000DHT)

Staking Rewards = 1200 DHT

Total $ Value = $928($0.24 DHT price)

See chart below for potential returns on DHT only pair:

Note: Each staked position, (vDHT,DHPT) is treated separately. To increase a stake a new position will need to be opened.

Implementation

The current DHT staking will be depreciated along with performance mining. The locked tokens will be claimable.

DHT Staking 2.0 will replace this.

Initially Staking 2.0 will only include 10 whitelisted dHEDGE pools.

The amount of rewards a staked (vDHT, DHPT) position receives varies with two factors: the amount of time the pair has been staked for (Duration Bonus), and the investing return that pool has returned since being staked (Performance Bonus)

-

The Duration Bonus is a linearly increasing factor from 0 to 1, which increases with time until maxing out at 6 months.

-

The Performance Bonus is a linearly increasing factor from 0 to 1, which increases with the returns of a pool performance(starting from the time it is staked). This maxes out if/when a pool achieves 50% returns. (e.g. 10% pool performance = a Performance Bonus of 0.2

vDHT

Staking DHT provides the staker with an incrementing amount of vDHT tokens over time. vDHT accrues linearly over a 12 month period until a maximum amount of vDHT is accrued, at a total of 1:1 to DHT initially staked.

In the below example, 100 DHT is staked at month 0. The returned vDHT accrues to 100 vDHT after 12 months.

The primary utility of vDHT is for voting as part of dHEDGE governance. It also factors into staking rewards, as it is then required to be paired with a staked dHEDGE Pool token to commence accruing rewards.

*Stake DHT → get vDHT.

DHT Staking rewards are derived from a combination of both vDHT and staked dHEDGE Pool Tokens(DHPT).

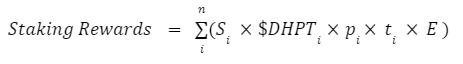

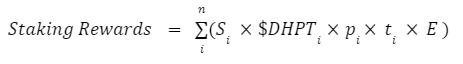

Staking rewards therefore are a direct product of:

Where:

vDHT = Staked DHT

S = Staking Ratio of vDHT:DHPT

$DHPT = Initial $ value of dHEDGE pool tokens

p = Performance Bonus

t = Duration Bonus

E = Emissions Rate

n = the total amount of different DHPT tokens

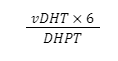

The Staking Ratio is a linear scale from 0 to 1 which is the ratio of:

To optimise staking returns, a staker must supply a minimum of 6x vDHT to the initial dollar value of the staked pool tokens. In the above equation, S needs to be greater than or equal to 6 for max rewards.

In the case where this ratio decreases, accrued rewards will be reduced by the same ratio.

Duration Bonus

Once invested in one or more dHEDGE pools, the associated pool tokens (DHPT) can be then staked on the platform to qualify for DHT staking rewards.

Once some DHPT is staked, a duration counter commences. As this period increases, so does the Duration Bonus, growing according to a linear relationship below.

The duration bonus rapidly increases linearly, to a max at the 6 month mark.

*Extended staking → increased Duration Bonus

Performance Bonus

In addition to being rewarded for extended periods of staking, DHT rewards are also boosted in relation to dHEDGE Pool performance.

By being invested in pools generating positive investment performance, DHT staking rewards are boosted to the staker along the Performance Bonus line below.

*Positive Pool Performance → increased Performance Bonus

Pools generating a loss receive a 0 Performance Bonus, which in the context of the overall staking rewards formula will generate 0 staking rewards.

Maximum Performance Bonus caps out after the staked pool token performance passes 50% from time staked.

Note: the Performance Bonus is a dynamic index which dictates staking returns at the point of claiming, and is not a cumulative function typical of other traditional DeFi staking programs.

Vote

Will be put up for vote in 2 weeks time.